46+ how much of your income should go to mortgage

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. With a general budget you want to.

The Vast Majority Of Respondents Said That If They Could Afford To Move Out They Would R Rebubble

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two.

. This means that if you want to keep. Compare Lenders And Find Out Which One Suits You Best. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Get The Service You Deserve With The Mortgage Lender You Trust. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

A front-end and back-end ratio. Ad Calculate the monthly and total payments of a mortgage. John in the above example makes.

Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. Web The amount of 1120 would be the max amount someone making 4000 a month could spend on the mortgage payment. Get Started Now With Quicken Loans.

Ad Compare Mortgage Options Get Quotes. And you should make. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Comparisons Trusted by 55000000. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Our Team Provides End-To-End Guidance To Help You Choose The Right Mortgage For Your Needs.

See How Much You Can Save with Low Money Down. Ad Compare Mortgage Options Get Quotes. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

Get Your Estimate Today. Get The Service You Deserve With The Mortgage Lender You Trust. Web The 2836 is based on two calculations.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. If you make 10000 a month before taxes you would.

Keep your total debt payments at or below 40 of your pretax. Ad Buying A Home. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Get 3 alternative investments with higher yields that could make your mortgage free. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just.

Looking For a House Loan. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Ad 5 Best House Loan Lenders Compared Reviewed.

Get Started Now With Quicken Loans. Well Automatically Calculate Your Estimated Down Payment. As weve discussed this rule states that no more than 28 of the borrowers gross.

Web How Much Mortgage Can I Afford. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Get Your Estimate Today. Were not including any expenses in estimating the.

How Much House Can I Afford Moneyunder30

Percentage Of Income For Mortgage Payments Quicken Loans

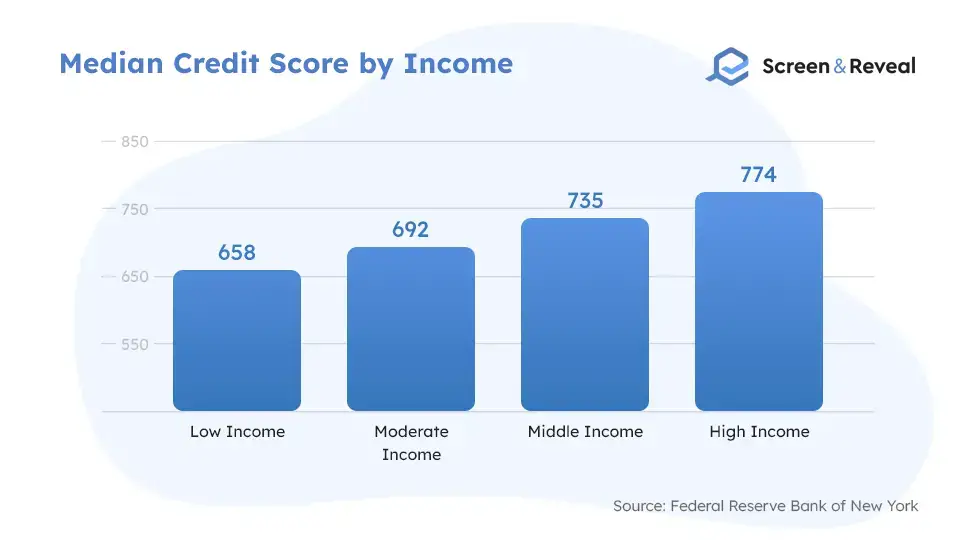

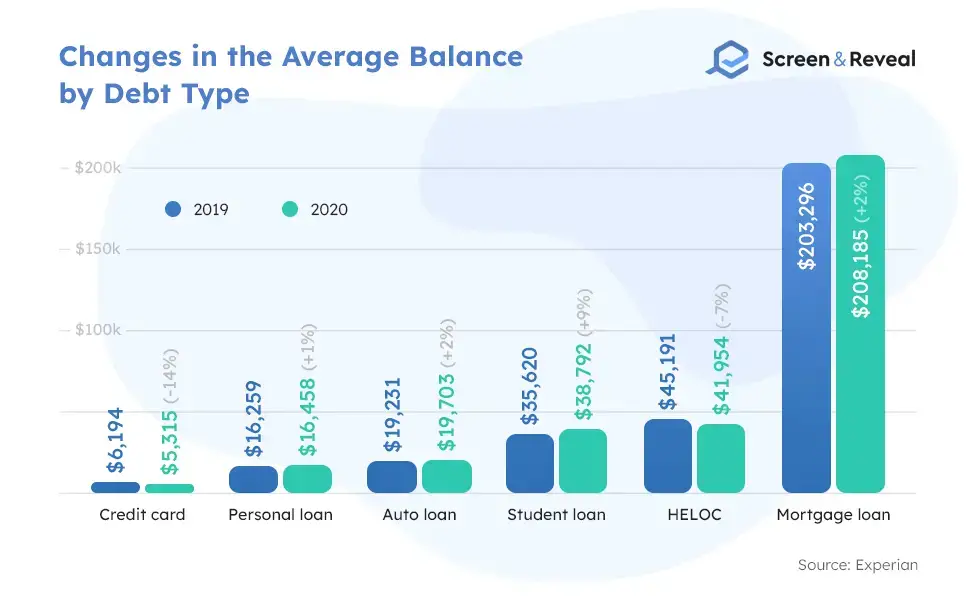

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income Should Go To Your Mortgage Hometap

September 2021 Issue By Housingwire Issuu

Here S What To Know About Turo And Credit Scores

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Dvvek9eupi Gum

Thairobbin Multiple Streamsofincome

How Much Home Can I Afford Mortgage Affordability Calculator

Homes Land Volume 46 Issue 12 By Homes Land Of Ocala Marion County Issuu

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

8798 Plainville Road Lysander Ny 13027 Mls S1434085 Howard Hanna

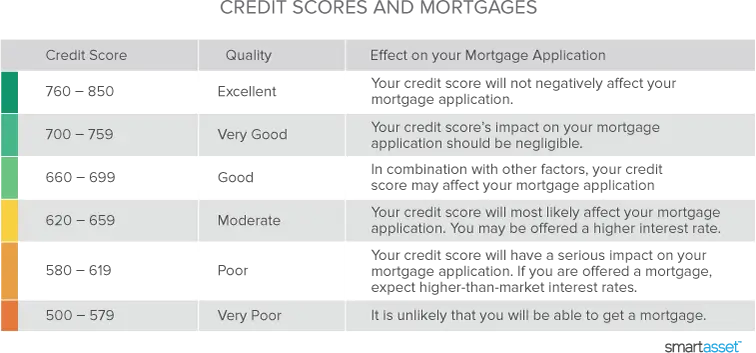

How Much Mortgage Can I Afford Smartasset Com

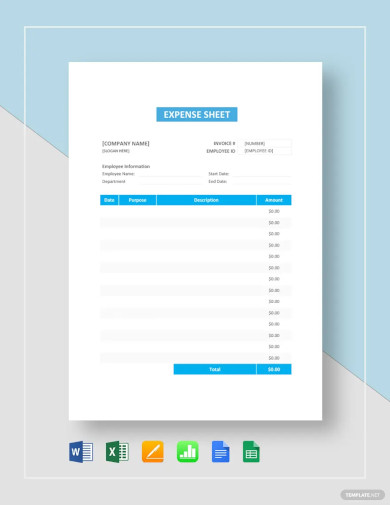

46 Sample Expense Sheet Templates In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages