Operating profit equation

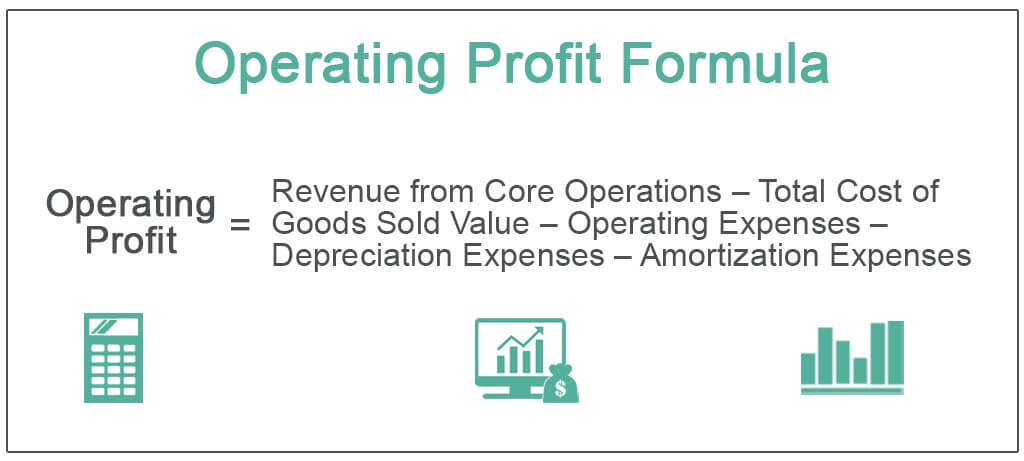

The operating profit equation is as follows. Operating Profit Revenue Cost of Goods Sold COGS Operating Expenses Depreciation Amortization Given the gross profit formula Revenue COGS the operating profit formula is.

Operating Profit

Operating Profit Margin.

. The formula for calculating operating profit is as follows. Where Gross Profit Net Sales- Cost of Goods Sold Gross Profit 60000 25000 Gross. The formula is below and we cover.

Operating Profit Ratio Formula Operating Income. Operating Profit Operating Revenue - Cost of Goods Sold COGS - Operating Expenses - Depreciation - Amortization. NOPAT Operating Income 1 Tax Rate where.

Operating Income Gross profits less operating expenses beginaligned textNOPAT textOperating Income. Operating profit can be calculated by deducting all the variable expenses from Gross Profit. Rent Utilities Insurance Employee wages Office supplies Commissions Postage and.

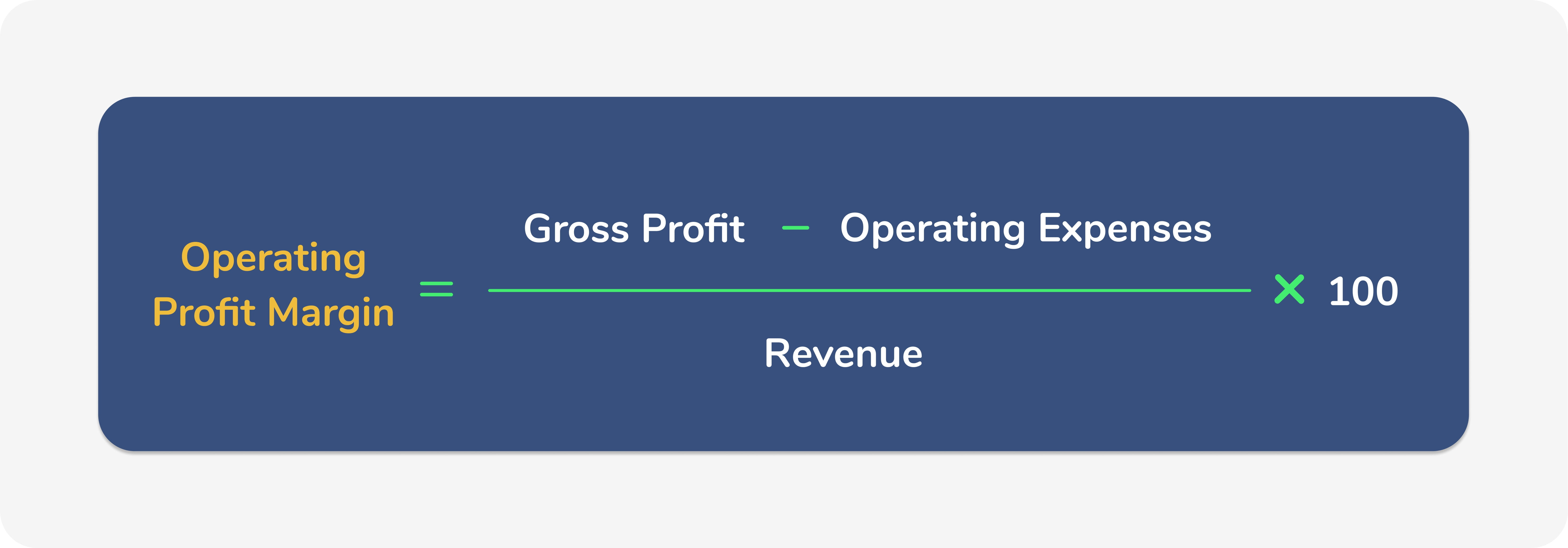

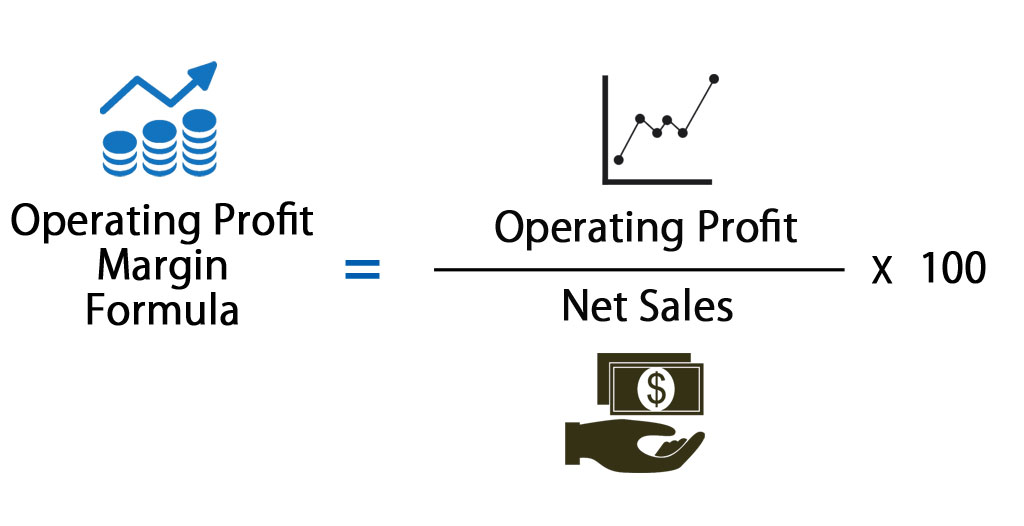

Operating profit margin is a profitability ratio used to determine the percentage of the profit the company generates from its operations before. Operating Profit Revenue Direct Costs Operating Costs rent salaries etc Why should you understand the profit equation. This income is the profit left after daily expenses and cost of goods have been deducted from net.

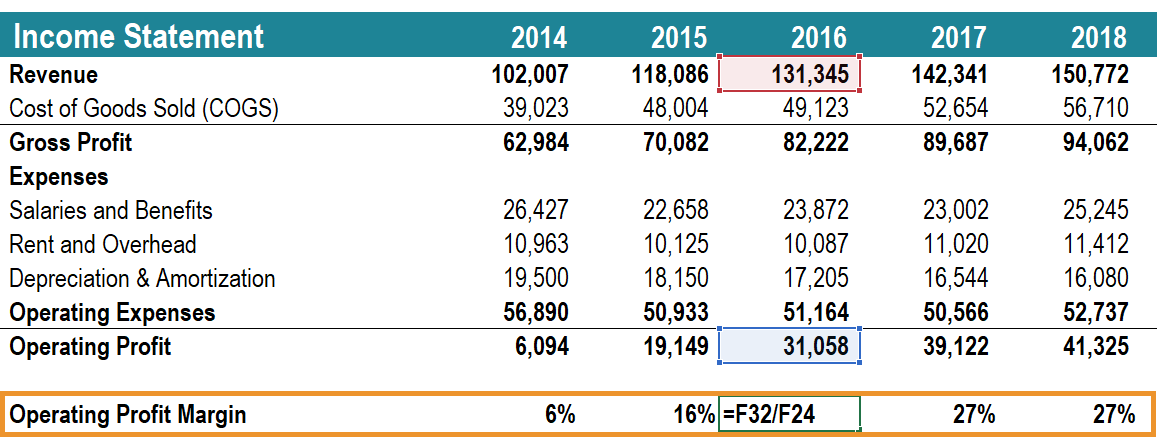

Gross Profit - Operating Expenses - Depreciation -. Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and. Operating profit 125000 85000 40000 Operating profit margin 40000300000 x 100 1333 Why is it important to know your Operating Profit Margin.

Operating Profit Margin Operating Income Revenue 100 3. Net profit equation The previous equations are ideal and provide. The operating profit formula and how to calculate it Operating profit is calculated using the following formula.

The following are examples of elements that may factor into the operating profit equation. Operating Profit Gross Profit Revenue - Cost of Goods Sold -. The best approach is to take the sales revenue of the business for a period and subtract the direct costs and operating expenses.

2- Operating Profit Net Profit Interest Expenses Taxes A companys operational profit might sometimes exceed its net profit or even net loss. By now you already might know the answer. Operating profit operating revenue - cost of goods sold COGS - operating expenses - depreciation -.

3jkjegsi9jgmum

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

Profit Margin Formula And Ratio Calculator

Gross Profit Accounting Play Medical School Stuff Accounting Accounting Basics

Net Income Formula Calculation And Example Net Income Accounting Education Accounting Principles

How Income Statement Structure Content Reveal Earning Performance Income Statement Cost Of Goods Sold Financial Statement Analysis

Operating Profit Formula How To Calculate Operating Profit

Operating Profit How To Calculate Operating Income

Myeducator Accounting Education Accounting Accounting Classes

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Operating Profit Margin Definition Formula And Calculation Wise Formerly Transferwise

Operating Profit Margin Formula Calculator Excel Template

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development

Ebit Meaning Importance And Calculation In 2022 Accounting Education Bookkeeping Business Small Business Bookkeeping

Operating Profit Margin Learn To Calculate Operating Profit Margin

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income